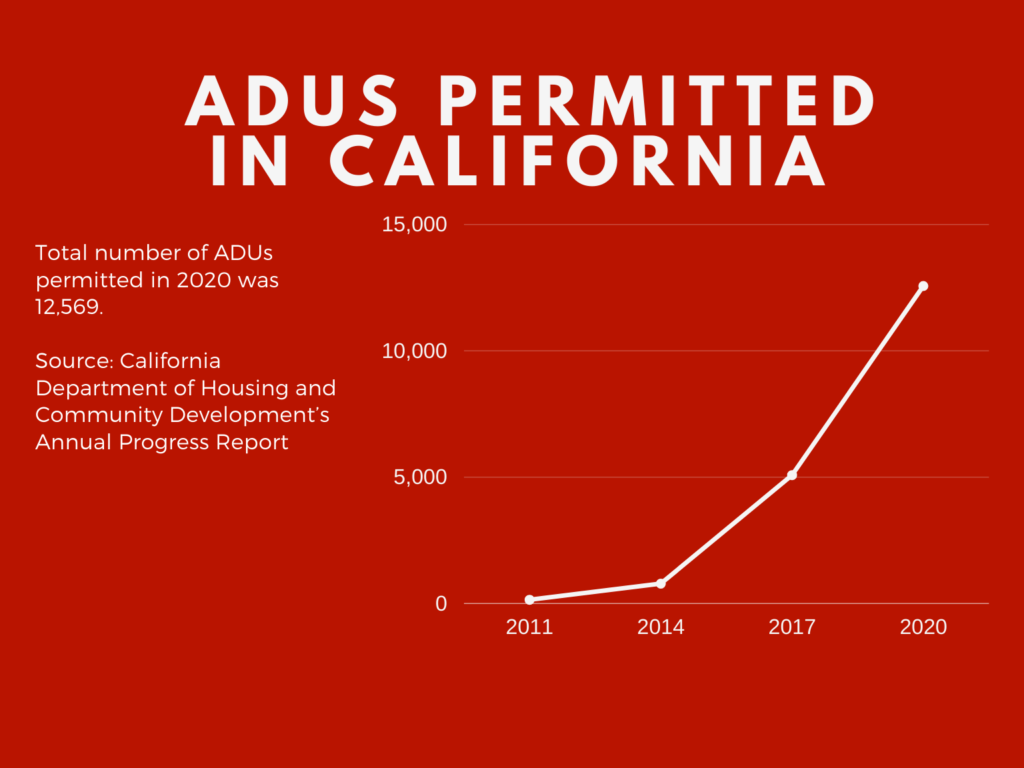

Knowing when to and how to turn your garage into a room is a game-changer for building home equity. In our published article about rising ADU house hacking trends, we explained why accessory dwelling unit apartments are exploding in popularity and how they can increase your home’s value.

Although many are eager to jump at the chance to build an ADU, we shouldn’t assume it will yield the most value.

Sometimes it makes more sense to convert your garage into an extra room. And I know, this is less sexy because it doesn’t offer the same passive income opportunity. But, if done right, it can radically transform your living space into the perfect dream home for your target demographic.

But also, forget target demographics. Knowing when to turn your garage into a room can make you forget about ever selling. It can offer you the space and comfort you need for generations to come.

We are going to explain the considerations of both options in terms of budget needs. And then, we will give example scenarios that will help you determine which option will offer the most return.

How to Calculate Costs for Turning Your Garage into an Apartment

When deciding between if you want to turn your garage into an apartment or room, you have to consider all the cost factors. Looking up the average costs per square footage isn’t enough. Although it’s a good starting point, these estimates will not help you make an informed budgeting decision. And it’s because there are key ADU design considerations that drastically swing the price in either direction.

The first design consideration is total living space. If you are only working with a single car garage, you have to install the same appliances you would for a double. This includes the plumbing and electricity for a kitchen, bathroom, and cleaning appliances.

If the living space is not enough, it may require expanding the foundation or adding a second floor above the garage. Both of these options add other material costs like roofing, concrete, and lumber. And if these options require more electrical and plumbing, the added labor costs will be more expensive per hour.

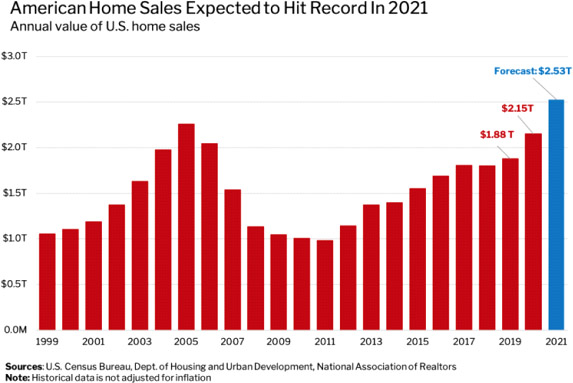

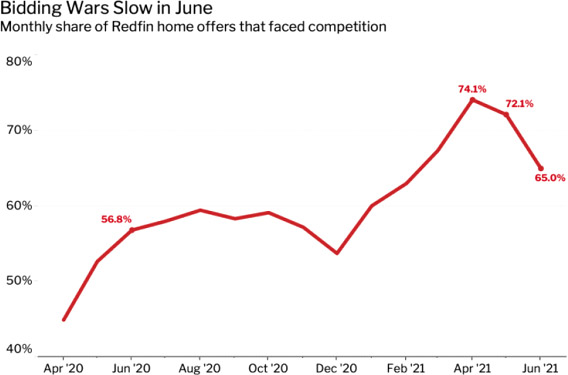

Sometimes these design decisions are worth the added costs because of the high housing demand. If you live in an area like Los Angeles and most places in southern California, then there is enough of a housing shortage and price squeeze to make this investment worth it in the long run.

But if your ROI objectives are less about building passive income, then there might be a better alternative to increasing the overall value of your home.

It is also important to calculate the permitting costs and the indirect permit requirement costs. For example, different cities have requirements on the space between the edge of the property and the ADU garage. Most require 4 feet set backs. Moving the edge of the garage to meet those requirements can be very expensive.

But you also want to keep in mind that the minimum size requirement is 150 square feet. So if you need to shrink the total square footage to accommodate for set back space, you need to make sure total square footage is above 150 sqft. Check out our ADU resources page for more info.

And check out our post on garage conversion permitting for more information on the permitting process.

How to Calculate the Cost of Turning a Garage into A Room

Non-ADU garage conversions have fewer city and design requirements. So, depending on the size and location of the garage, turning a garage into a non-ADU room can cost a lot less and may fit your budget.

Even though the non-ADU garage conversions cost less, the return on investment is harder to calculate. And the reason is that the return is contextual to the specific solution that the garage conversion provides.

For example, if your house only has one bedroom, turning your garage into a second bedroom adds more value by changing the home classification. Room additions have diminishing returns, though. For example, going from a one-bedroom to a two-bedroom adds a lot more value than going from a five-bedroom to a six-bedroom. The reason is simple supply and demand.

If you look at population trends, most areas see a decline in the number of children per family unit. As a result, demand for houses with four bedrooms and up is going down.

Now, if you are turning a single car garage into a spare room, then the most significant cost considerations are flooring materials, windows and doors, and electrical and heating. But, if you are turning a two-car garage into a master bedroom, then you will most likely need to factor in the cost of a master bathroom as well. Either option, though, will still be less expensive per square foot than an ADU conversion.

How to Compare Value of Garage Conversion Options

So now that you have a basic overview of cost factors for garage conversions, the big question is, how do you determine which option will yield the most value?

Non ADU value calculation:

Any added square footage to your home adds an average of 30% in resale value, but all of this is dependent on what the added space accomplishes for your home. A bedroom can be a safe bet, but its potential value can vary depending on your neighborhood. If you have a one-bedroom, research the average cost of a two-bedroom in your neighborhood. But also look for other buying obstacles that the extra space in the garage could solve.

For example, if your kitchen and living room area is too small for a dining table, knocking down the wall between the living room and the garage could transform any home’s most important selling point. The ROI of this option is harder to quantify through a google search, but one of our experts could give you an informed estimate.

Using the garage to expand your kitchen or living space can also provide more natural light. It is widespread and even recommended to keep the garage door opening when you turn your garage into a room or apartment. The first reason is that it makes it easier for future homeowners to turn it back if they wish. But secondly, it is an excellent source of natural light.

One of our clients recently combined their garage with a kitchen remodel. And they kept the garage opening! The added natural light in the kitchen and living space completely transformed the aura.

ADU value calculation:

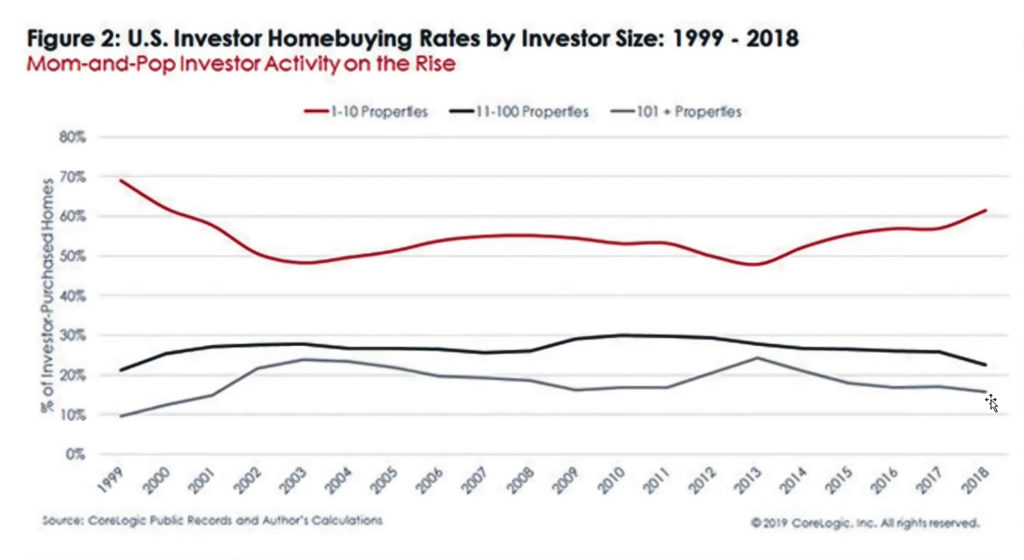

If you want to calculate the potential resale value of a home with an ADU on it, then you will want to think like a real estate developing investor. Since your property would be zoned for two separate rental units, you will want to calculate the total amount of rental income your property could generate.

Then you will want to factor in interest rates to calculate a mortgage cost that would offer an investor 5-10% in profit. If that price is more than what you calculated for the room addition, then an ADU conversion may offer more resale value.

Once you have calculated the potential added value of each option, you need to subtract the cost estimate to come up with a return on investment. We can help with all of these steps. And we even recommend that you shop around to be confident that you have the best investment strategy. Our contractors and designers love to think outside of the box to provide the best results. Give us a call for a free consultation!

NEXT ARTICLE

How to Use New ADU laws to Make Passive Income With Rental Property

RELATED LINKS

The Ultimate ADU Resource Center

How to Get a Permit for Garage Conversion in Los Angeles

California ADU and Garage Conversion Builders and Resources