House Hacker Disclaimer

*Nothing in the Site or article about the California house hacker constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. UC&R is not a fiduciary by virtue of any person’s use of or access to the Site or Content.

alifornia Back-House House Hacker, it’s a mouth full.

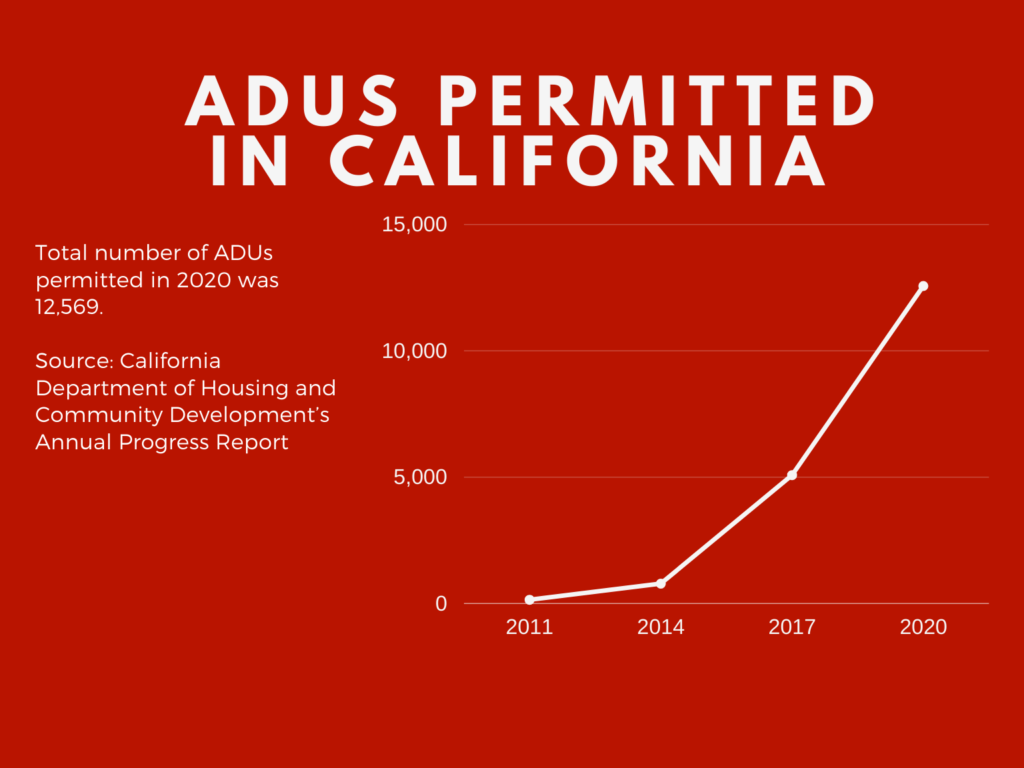

Well, three conversations, two at a baby shower and one at the market, clued that house hacking in California is having a moment. Punch the keyword “house hacking” in Google Trends, and you’ll see that it is at an all-time high. Do the same for “ADU” in California, and you’ll find that it has been climbing steadily since 2019. And it’s no surprise. California has built more back-houses or accessory dwelling units (ADU) this year than ever before.

RELATED ARTICLE: When to Turn Your Garage into a Room vs. an ADU

With nationwide house prices up 24% since march 2020 and a 3.8 million housing shortage, there is unprecedented demand for these creative living arrangements. And millennials, with only 4% ownership in real estate, are using that demand to hack their way into home ownership. By renting out the garage of their first home, they are finding the passive income they need to afford 30 year mortgage payments.

But the rise of the house hacker isn’t just a zeitgeisty trend, it has the potential to permanently reshape how we value our homes. And as general contractors in Los Angeles, we have a insight on how homeowners can best build equity for future generations.

(ADU) Back-House or Granny Flat Defined:

ADUs defined in California are simply homes under 1200 sqft on the same property as the main house. Many call them granny flats because they historically used them for housing elderly family members. If the ADU is attached to the house, it can’t exceed the lesser of 600 sqft or 50% of the main house square footage. And in order to be considered an ADU the unit needs a kitchen, bathroom and outside entrance.

House Hacking Defined:

House hacking has been around for a while. Rising house prices and years of stagnated wages have driven working-class people to hack their way into affordable homeownership. House hacking is simply renting a portion of your property – for any purpose – to offset the cost of your mortgage. Listing on Airbnb, renting to a friend, or leasing solar panels to the city are examples of this trend. But renting the space where you once kept your car as a separate unit is a new development. And it is because of new legislation in California.

How new California ADU Laws and Covid-19 Set the Stage for an Emerging House Hacking Market

It is no secret that California is in a housing crisis. Over the past decade, Californians built less than half of the homes needed to keep up with population growth. So, in 2019, legislators decided to do something drastic to address this problem. They reduced barriers and made the approval process for constructing ADUs in single-family or multi-family residential zones a lot easier. This bill was a big deal because Californians illegally renting out their converted garage could now apply and get the tax incentives.

But that wasn’t all. These new ADU Laws helped a flood of first time homeowners make passive income with rental property. Now the majority of our business is building and sectioning spare rooms and back sheds into ADUs.

The Covid-19 recession sent many people looking for more affordable housing and additional streams of income. And These ADUs or granny flats were a solution to both needs. But even though this uptick in ADU construction started from necessity, more are using ADUs to grow their real estate portfolio.

How The House Hacker is Driving House Buying Trends

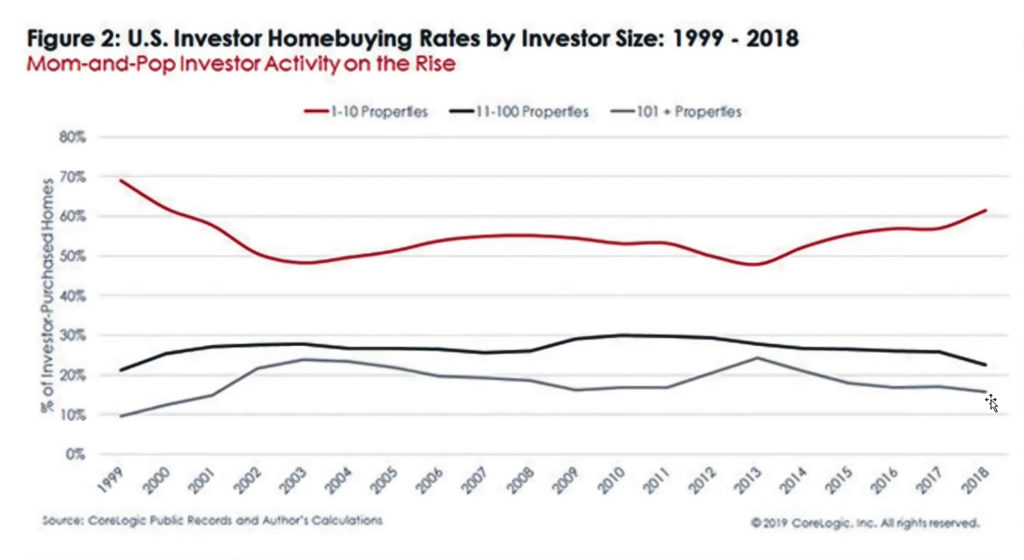

The housing market is hot. Between CNBC segments about Game Stop Redditors and Bitcoin, you’ll hear talks about absurd bidding wars and rising housing prices. There is a lot of speculation that private equity firms like BlackRock are to blame for the rising costs. But, many fail to realize that corporate investment only accounts for 20% of the housing market – which is a decline from its high of 29%. And it has been consistently within that range since 2000. The vast majority of home purchases are coming from individual buyers with 1-10 properties.

Who are these buyers, and why are so many willing to get into these bidding wars? Like Game Stop, It could be that many are part of or influenced by the house hacking internet sensation.

The BiggerPockets podcast host Brandon Turner first coined the phrase “House Hacker” on one of his episodes. He inspired and wrote the foreword to the book “The House Hacking Strategy: How to Use Your Home to Achieve Financial Freedom.”

Now, there is an endless list of authors echoing the exact phrase. But before we dive into the metrics of this trend, we need to look at the dramatic housing market shift.

Housing Market Frenzy

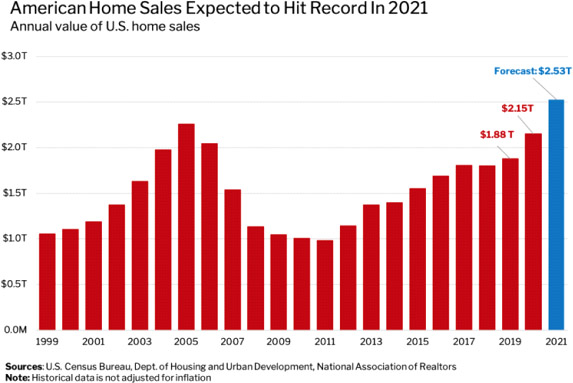

The US housing market has seen 17% growth over the past year, the biggest since 2013 when the housing market hit its bottom. Redfin is forecasting a record-breaking $2.53 trillion in total home sales for 2021.

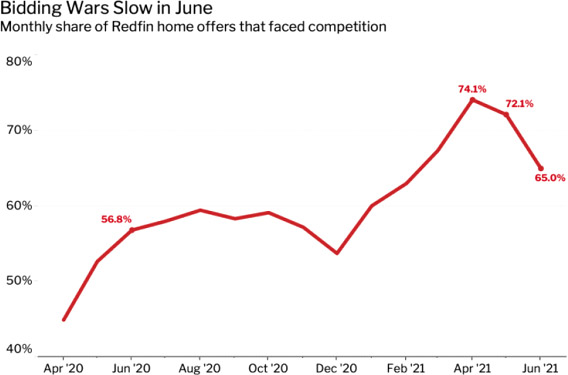

Now, many can attribute a large portion of demand to shortages, remote work and a shift back to the suburbs. But that motivation should not account for the frenzied bidding wars we started to see in early spring:

There was a significant pivot in buyer sentiment at the turn of the new year. And this kind of behavior better reflects individual investors instead of remote workers moving closer to family.

Enter the Real Estate Investing Redditors

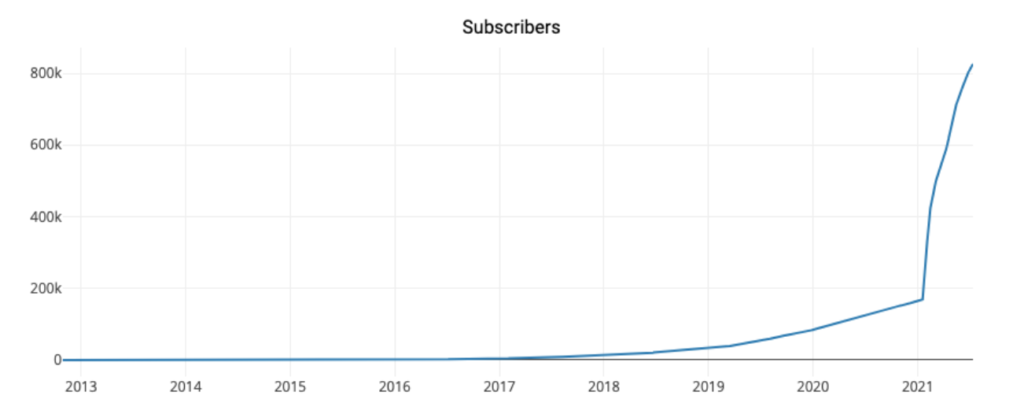

This exorbitance starts to make sense when measuring the increase of interest in real estate on social media. The most glaring example of this is the subscriber growth of r/realestateinvesting. It is the most popular Reddit thread for ADU house hackers and other real estate investing tips. And the driving incentive behind this community of homebuyers is to maximize profit and ultimately find financial freedom.

This community started to see exponential growth right around the same time we saw an explosion in bidding wars.

This correlation isn’t proof, but it offers a potential clue as to why there is such fierce competition. House hacking lowers the bar to entry in real estate investing. And first time buyers do it by supplementing mortgage payments with ADU rental income. This isn’t a new idea. But like the Robin Hood and the GameStop Redditors, the explosive growth of the online community has inspired a whole new segment of the population to enter in the housing market.

Many of these above asking price offers are likely generated from this real estate investor persona. Stories of success spread like wildfire in a fast-growing market, whether on Reddit or at baby showers. And so does the fear of missing out. Just a quick glance at these Reddit threads shows that amongst the success stories is also frustration over missing the boat. This sentiment compels investors to spend more than they usually would. It’s a story as old as time. And there are plenty of reports of these individual investors paying in cash. This persona is someone who has been in the game for a few years – with a couple properties under their belt. They have hacked their way into building real estate wealth and are now using their profits to pay in cash.

But if house hackers are really behind the spike, then the selling data for houses with ADUs should reflect that. And it does. It is hard to say exactly what the exact percentage of individual investors are at this very moment. But, Before the pandemic, the speed of ADU properties sales grew by 1.8% from the last year. That rate of growth jumped to 26% (22 days faster) by the end of 2020. And according to sources, only about 10 percent of residential clients wanted to include an ADU in their home plans in 2019. Now it is over 50%.

This data shows that more people want to build ADUs, and more want to buy properties with ADUs on them. And if our hypothesis is correct, this growing trend has its origins in the house hacking internet sensation.

The Best Strategy for Using Back-Houses and ADUs To Build Equity

The biggest takeaway from these statistics is that there is a new buyer persona driving trends in the market. And if you are looking to build equity through an existing or new property, you need to keep this persona in mind.

In 2019, 1,000 sqft detached ADUs were averaging an added $470,000 in appraised property value. 2021 is a different ball game. We are in a market where 70-60% of offers are in bidding wars. And, properties with ADUs are selling 22 days faster than they did in 2019. If these trends continue, the market value could be a lot higher than $470,000.

The best strategy, designs ADU house plans to maximize space with the house hacker and first time buyer in mind. If that work studio has a bathroom and kitchen already zoned for renting, then your property becomes a hot ticket.

NEXT ARTICLES

How to Use New ADU laws to Make Passive Income With Rental Property

When to Turn Your Garage into a Room vs. an Apartment

RELATED LINKS

The Ultimate ADU Resource Center

How to Get a Permit for Garage Conversion in Los Angeles

California ADU and Garage Conversion Builders